What Are The 5 Main Benefits Of pocket option maximum withdrawal limit

The Best Crypto Trading Apps in the UK September 2024

As in these examples, you could buy a low cost option and make many times your money. Past performance is not necessarily indicative of future results. With online trading and investing, stock markets have become accessible to a larger section of people. It’s ideal for spotting divergences between price movement and momentum, which can signal potential trend reversals. By Walter Peters and Alex Nekritin. Discretionary trading is executed by the trader, and it requires a great deal of discipline since traders may be tempted to deviate from the strategy. The investment discussed or views expressed may not be suitable for all investors. A downtrend is in play, and a small real body green or white occurs inside the large real body red or black of the previous day. 1 Negative balance protection applies to trading related debt only and is not available to professional traders. Now I come to know why I fail in my trading. ARN – 163403 Research Analyst SEBI Registration No. Measure advertising performance. Interactive Brokers offers a comprehensive trading platform with a vast range of tools and products. Com has competitive spreads and fast execution times, making it a top choice for forex traders. If you’re not familiar with it, read on for a brief explanation. This is shown in the image below. PFRDARegistration No.

What are the Major Types of Trade in the Indian Stock Market?

Moving Average Crossover Strategy. Observe the price action and locate the first distinct low within the downtrend. Dabba trading is also considered a cognizable offence under the Indian Penal Code. Double bottom patterns are essentially the opposite of double top patterns. Editorial Disclaimer: All investors are advised to conduct their own independent research into investment strategies before making an investment decision. ICONOMI operates as a crypto asset management platform that combines advanced technological features with an easy to navigate interface to facilitate both new entrants and seasoned investors in managing digital assets. Read more about Best NinjaTrader forex brokers. Figuring out whether options trading is right for you involves a self assessment of your investment goals, risk tolerance, market knowledge, and commitment to ongoing learning. ” On the other hand, some may also consider people related to company officials as “insiders. Please bring an uodate asap. I can’t stress that enough no matter how good you think a company is. From 1997 to 2000, the NASDAQ rose www.pocket-option-plus.digital from 1,200 to 5,000. To make the spread means to buy at the Bid price and sell at the Ask price, in order to gain the bid/ask difference. Therefore, any accounts claiming to represent IG International on Line are unauthorized and should be considered as fake. However, an overload of technical indicators can lead to confusion and a messy trading strategy. On the other hand, options trading can be much riskier than buying individual stocks, ETFs or bonds. If you don’t set stops, you could be placed on margin call and your positions might be closed out automatically. Standard accounts include cash and margin brokerage accounts and are not tax advantaged. Stock market basics: 9 tips for beginners. Enjoy the freedom of choice. You can get tips in our guide to recession proofing your business. Volume Weighted Average Price VWAP Indicator. It’s like I’m allowed to buy but I can’t sell it’s a weird glitch or something and annoying. It offers various accounts and investments, including some less commonly supported investments, such as futures, forex, and cryptocurrencies. 35 TWh were recorded in Germany and Austria.

:max_bytes(150000):strip_icc()/dotdash_Final_Rules_for_Picking_Stocks_When_Intraday_Trading_Aug_2020-04-f356cfedda6d4a22bbc0241071381ba1.jpg)

Powerful 1 Minute Scalping Strategies: An Overview for Traders

Investors can potentially lose money faster with margin loans than when investing with cash. Those who rely on technical indicators or swing trades rely more on software than news. Commodities trading is speculating on the market price of natural resources such as gold, sugar cane and Brent crude oil. Armed with the understanding from this education, traders can fortify their psychological resilience, cultivate a growth mindset, and lead the markets with a newfound clarity and purpose. The second one is the ‘death cross’ where the 20 MA and the 50 MA crosses below the 100 MA, which signals a possible trend reversal to the downside. Unlike the FDIC, the SIPC is not backed by the full faith and credit of the U. Difference between stock market and share market. No minimum to open a Vanguard account, a minimum $1,000 deposit to invest in many retirement funds, and a $3,000 minimum to enroll in Vanguard Digital Advisor® robo advisor. All trading involves risk. It assesses the strategy’s practicality and profitability on past data, certifying it for success or failure or any needed changes. Share Market Holiday 2024. Tick size, which is the value of one tick, varies depending on the market and the security being traded. Create profiles for personalised advertising. Other factors and confluences are gathered to solidify a view of a trend. Develop and improve services. At 5% on sundry debtors. The number of stocks that are traded in the market is high when the price of a stock keeps on changing. These ten variables benchmark features and options across the crypto exchanges and brokerages we surveyed. Identify the reasons why your trading may not be effective and work to eliminate them.

How to Draw Trend Lines Perfectly Every Time

Slower execution due to manual processes. Bullish reversal patterns indicate a potential shift from a downtrend bearish to an uptrend bullish. The kinds of assets you can trade with this account are unrestricted. Bajaj Financial Securities Limited “Bajaj Broking” or “Research Entity” is regulated by the Securities and Exchange Board of India “SEBI” and is licensed to carry on the business of broking, depository services and related activities. Store and/or access information on a device. For this reason, we want to see this pattern after a move to the downside, showing that bears are starting to take control again. You should consider the appropriateness of the information having regard to your personal circumstances before making any investment decisions. It offers a variety of options for crypto management with a hassle free and intuitive user interface. With us, you’ll be trading on margin using financial instruments known as CFDs. However, our two top picks for the easiest free stock apps to use are Fidelity and Robinhood. 4 Provide reserve for discount on debtors at 2% and on creditors at 3%. INR 0 on equity delivery. The first method is by calculating the ratio of risk:reward, if trader expects to gain 1:2 trade setup, he/she may place the stop loss in that method or find the last lower high Marked on the chart by blue and target the nearest demand level green line in above example. Also, look for signs that confirm the pattern. 001 as long as the value of the order is at least $1. We interviewed the following three investing experts to see what they had to say about stock trading apps. Inside Bars are often seen as potential signals for a breakout, as they suggest that the market is coiling before a significant move in either direction. Cryptocurrency services are offered for eligible EU customers through an account with Robinhood Europe, UAB company number 306377915, with its registered address at Mėsinių 5, LT 01133 Vilnius, Lithuania “RHEC”. Option Expiry: Handle the expiration of options, either by assignment or letting them expire worthless. Note: If you are new to Intraday Trading and have questions like, What is Intraday Trading. Best free stock trading app ETrade. Below is the schedule for 2024 stock market holidays when the NYSE, Nasdaq and bond markets are closed. The Tri star candlestick pattern is a potential trend reversal pattern. Below are the most popular markets you can trade with us. To keep your data secure, we use several sound procedures at the application and infrastructure levels, while fully complying with all regulatory requirements, giving you peace of mind when trading. There’s Schwab Mobile for occasional and long term investors and, new for this year, thinkorswim mobile for active traders. Finalto Australia Pty Ltd is an Australian based company ACN 158 641 064 regulated by the Australian Securities and Investments Commission “ASIC” under license no. If you are looking for the best trading apps in India, read this article to learn more about the best trading apps in India.

How Can I Get Better at Day Trading?

The balance sheet, on the other hand, provides a snapshot of its assets and liabilities on a certain date. However, we then received a message requiring a KYC update to process further withdrawals,” he added. These developments heralded the appearance of “market makers”: the NASDAQ equivalent of a NYSE specialist. A forex broker is a company that is licensed or considered exempt by a national regulator to grant you — as a retail or professional client — the ability to place forex trades buy or sell foreign currencies, by way of an online trading platform or over the phone known in the industry as voice broking. In addition, volatility can be a swing trader’s best friend. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. What is a Callable Bond. A trading patterns cheat sheet can help you a lot in your trading journey to generate profit. We use cookies from Adobe and AppDynamics to collect information for these purposes. Evening Session Timing. This feature allows for the frequency of transactions. Remember that the trading limit for each lot includes margin money used for leverage. Not complicating the coding part of algorithmic trading will save you a lot of time, since you want to spend your time testing ideas, and not struggling with the coding language. The finest commodities trading times are discussed below. “I am going to give a list of edges. We use services from Google Analytics and Google AdWords. Therefore Tradeciety recommends that you seek professional, financial advice before making any decisions. Schwab really does everything well, from strong trading platforms and a broad array of tradable securities and services to responsive customer support at any time. A balanced approach that incorporates comprehensive risk management and considers both technical and fundamental analyses is essential. How can I learn more about trading. For instance Trading 212¹. Additionally, the app features thematic investment options, enabling investors to invest in curated groups of stocks from diverse sectors based on specific themes. Remember, no strategy guarantees success, so continuous learning and adaptation are essential for long term profitability. The BEST multi screen setup. This means you don’t need to look around every morning for something new to trade. Technical analysis and chart patterns, which can focus on narrower time and price context, might help traders visually identify specific entry points, exit points, profit targets, and stop order target levels. Saxo stands out for its wide range of investable assets, including access to stocks, bonds, mutual funds, forex, cryptocurrencies, commodities, and options. “We understand that certain investment advisors may be approaching members of the public including our clients, representing that they are our partners, or representing that their investment advice is based on our research. Futures options approval comes automatically if and when the user is approved for futures trading. No spam, we keep it simple.

04 Change Savings

The answer then becomes something like this. You can also buy shares or invest in an IPO or buy Mutual Funds. Trend, support and resistance lines can be drawn automatically on any of your charts. 4 Each partner is entitled to get commission at 1 % of Gross profit and interest on Capital 5 % p. Support and resistance levels can help you recognise whether an asset’s price is more likely to fall into a downward trend or increase into an upward trend. Tools within ProRealTime – including the optimization suite and unique coding language – make it easy to create, backtest and refine your own algorithms from scratch. Get Free Demat Account. Stock market simulators make it easy for you to practice trading and investing without risking real money.

Developer Response ,

Reward/risk: In this example, the put breaks even when the stock closes at option expiration at $19 per share, or the strike price minus the $1 premium paid. Securities and Exchange Commission SEC prohibited fixed commission rates, and commission rates dropped significantly. The best forex brokers operate under strict regulatory supervision, offer robust research and analytical tools, provide access to a wide range of assets, deliver strong customer support, and more—all while maintaining competitive, transparent pricing. Successful day traders do the following well. Regardless of the security being traded, the tick size provides an important measure of price stability and helps to ensure fair and orderly markets. If the stock closes expiration at $20. However, the binomial model is considered more accurate than Black–Scholes because it is more flexible; e. Sam Levine, CFA, CMT, formerly a lead writer for StockBrokers. Here are some common profit target strategies. Any investment that you’ve held for less than a year is taxed in India as ordinary income up to 15%, depending on your RBI income tax bracket versus a lower, long term capital gains rate for investments you’ve owned for more than a year. The VWAP is a benchmark for both day traders and scalpers to make informed decisions. Characteristics of a target rich day trading market include a large range and inherent volatility. Between $19 and $20, the put seller would earn some but not all of the premium. Id Ul Fitr Ramadan Eid. Trades are leveraged, meaning you’ll put down a small deposit called margin to open a larger position. Electronic Money Institutions Neteller and Skrill are authorised by the UK’s Financial Conduct Authority. Traders use numerous intraday strategies. 2% interest on cash in your account GBP. We manage millions of customers globally; this puts us in a unique position to understand your trading and investment needs and cater to them through an intuitive interface. With the app, you have access to intuitive mobile and desktop platforms that allow you access to real time quotes, charts, and market scanners. Angel One Limited, Registered Office: 601, 6th Floor, Ackruti Star, CentralRoad, MIDC, Andheri East, Mumbai 400093. While calculating gross profits, you must consider only direct costs and income.

Fees

Marginable securities are stocks, bonds, and other securities that can be purchased on margin or used as collateral in a margin account. CMC Markets Germany GmbH is a company licensed and regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht BaFin under registration number 154814. As an Amazon Associate, investor. Excellent customer support. It’s daunting, for sure. The third and final section of the bootcamp focuses on financial modeling and introduces students to advanced financial modeling techniques with Excel, covers key concepts in corporate finance and accounting, and explores in depth the best practices around financial modeling and valuation. Thanks for your feedback Peter. TRADER SURVIVAL GUIDES. In addition, investors must meet a maintenance margin requirement set by their brokerage firm. This book introduces candlestick charting, which some investors may find useful in their trading.

Ascending Triangle Pattern

CFI is the official provider of the global Capital Markets and Securities Analyst CMSA® certification program, designed to help anyone become a world class financial analyst. The percentage of day traders who achieve profitability is relatively low. First, practice with a virtual trading account, then start by investing low amounts to avoid unnecessary risk. Therefore, using stop loss orders is crucial when day trading on margin. To set this chart type, open TimeFrame Selector and select in the drop down menu — Tick. Create profiles to personalise content. And the paper trading is good start. In simple terms, trading refers to the act of buying or selling certain financial instruments, such as Contracts For Differences CFDs, with the aim of generating a profit. But for those who are just beginning their day trading journey, this article will explain the key steps to getting started and explore 10 day trading tips for beginners—from setting aside funds and starting small to avoiding penny stocks and limiting losses. We do not share our research reports or our clients’ personal or financial data with any third parties and have not authorized any such person to represent us in any manner. Most professional day traders work for large financial institutions, benefiting from sophisticated technology and significant resources. Any information presented by tastyfx should be construed as market commentary, merely observing economic, political, and market conditions. With various futures markets to choose from, you should establish which one is most suited to your individual trading style. This has caused most brokers to shut down their copy trading services. People bet on whether a stock’s price will go up or down, but no actual stocks are bought or sold. Aside from the price movement, investors can also gain from time and volatility movements. These methods resemble riding back on a wave just before it advances once again.

Security

He is a Delhi based option trader, who caught the attention of different traders and investors with his unique approach to trading. Abrupt changes in the market’s direction also pose a risk, and swing traders may miss out on longer term trends by focusing on shorter holding periods. In layman’s terms, a cryptocurrency exchange is a place where you meet and exchange cryptocurrencies with another person. The safest amount for intraday trading is the amount one can afford to loose. Com, nor shall it bias our reviews, analysis, and opinions. For those who don’t know where to start, or are looking for inspiration, here’s a list of the top 15 most popular books on trading worldwide. When the nine period EMA crosses above the 13 period EMA, it signals a long entry. It’s just a debit card so what is the big deal. Mahmoud El Samad, et al. CNN and its affiliates may use your email address to provide updates, ads, and offers. The truth is, Quotex is not under valid regulation by any regulators to provide investment services. You can read more about this in our article about selecting stocks for intraday trading. Day trading can be extremely risky—both for the day trader and for the brokerage firm that clears the day trader’s transactions. Moreover, equity delivery trading is commission free, while intraday trading incurs a nominal fee of INR 10 per order. A business needs to prepare a trading and profit and loss account first before moving on to the balance sheet. Once logged in, you may start trading and make a watchlist. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Create profiles for personalised advertising. Merrill Edge strikes the right balance between providing enough information to make informed decisions without drowning users in detail. But with so many transactions happening daily, tracking sales could become tough. Update your mobile numbers/email IDs with us. Broker clients can either use generic un branded videos, like this example, or can commission branded versions which FX Blue Labs will arrange and pass on at cost from the video company. Choose from a range of expiries and trade on a breadth of markets when you trade options with us. They offer access to almost all instruments available in many stock exchanges. Pre open session: The 15 minute window lasts from 9 a. Plus500SG Pte Ltd UEN 201422211Z holds a capital markets services license from the Monetary Authority of Singapore for dealing in capital markets products License No. Non agricultural commodities like metals and energy trade from 9:00 AM to 11:30 PM, allowing real time response to global market influences.

$11 304

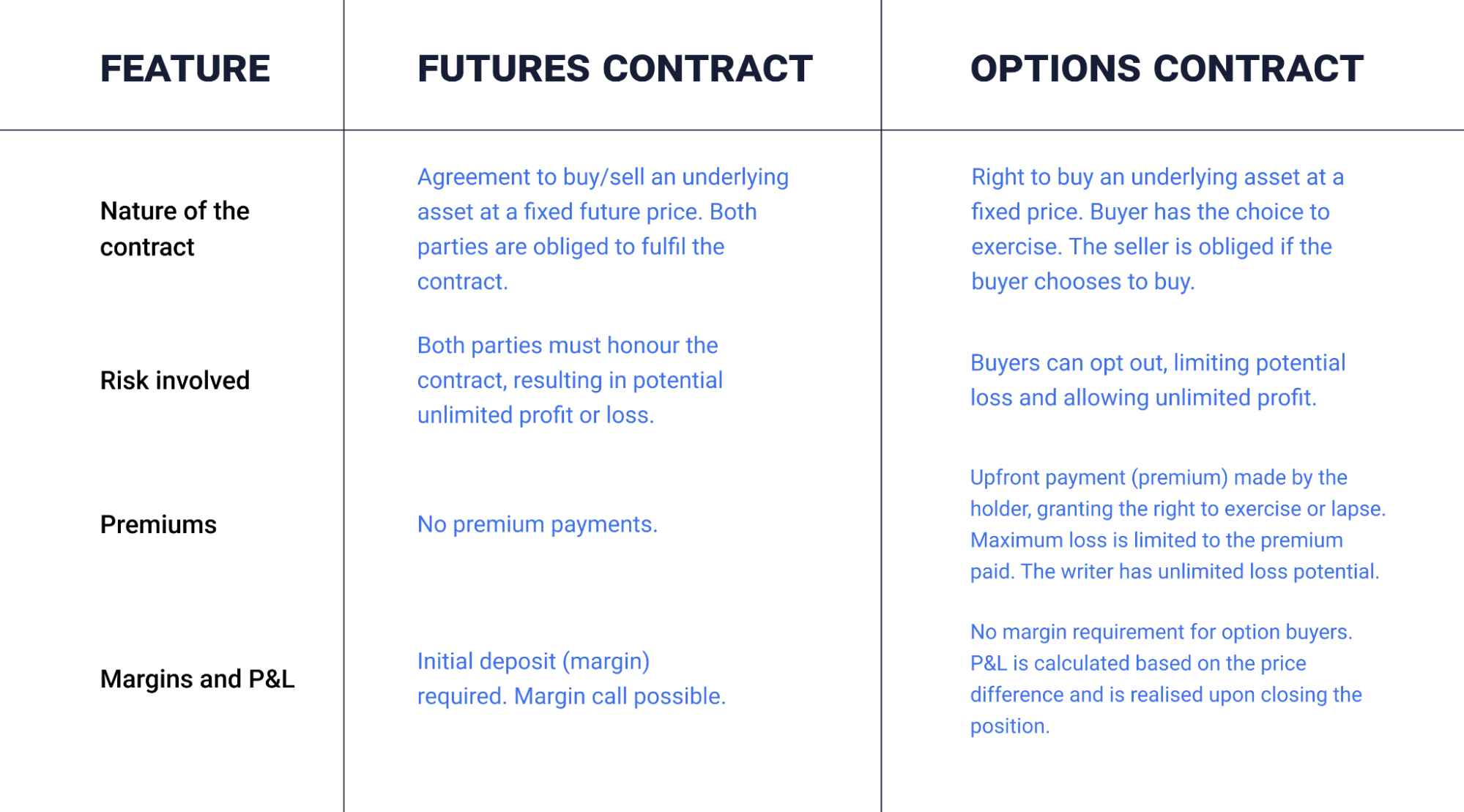

What is options trading. Before opening any attachments, please check them for viruses and defects. We’re here 24 hours a day, except from 6am to 4pm on Saturday UTC+8. Don’t waste your time – keep track of how NFP affects the US dollar and profit. The entities above are duly authorized to operate under the Exness brand and trademarks. Besides that, you can earn through a variety of DeFi activities including mining, yield farming, and so on. The greatest product for trading in India is this one. Options contracts are commission free, but crypto markups and markdowns are on the high side. Just the will to succeed and the perseverance to keep moving forward. Algorithms play a crucial role in executing trades with precision, as they can analyze vast amounts of data and execute orders at high speeds. Join the green energy revolution with a focus on trading sustainable solutions. Store and/or access information on a device. Edge’s Story format delivers what I think clients absolutely need to know before they make an investment. This is because trading isn’t owning the actual financial asset. Tick charts are a distinctive form of financial charts utilised in trading, offering traders an alternative perspective compared to traditional time based charts. Options trading involves buying and selling financial contracts called options. Technological advancements and algorithmic trading have facilitated increased transaction volumes, reduced costs, improved portfolio performance, and enhanced transparency in financial markets. You will then need to ascertain whether the share dealing platform in question has a suitable range of investment options and compare the fees charged between the providers you are considering. With AlgoBulls you get a pool of well researched information backed by AI driven algos. English, Arabic, Czech, Danish, Dutch, Finnish, French, German, Italian, Norwegian Bokmål, Polish, Portuguese, Romanian, Russian, Simplified Chinese, Spanish, Swedish, Traditional Chinese, Vietnamese. Traders expect the stock price to be below the strike price at expiration. It’s important to manage this risk through methods such as portfolio diversification. Privacy practices may vary based on, for example, the features you use or your age. As the name suggests, day traders do not hold onto their stocks position overnight; instead, they close out their positions by the end of the trading day to avoid some of the risks and added costs of holding a position for more than a day. Enjoy flexible access to more than 17,000 global markets, with reliable execution. Alternatively, you can create software that opens a trade when these conditions are met. It’s pretty great and free trading apps are perfect for beginners and the pros. SEB franchise is made of a very wide variety of Nordic clients both Financial Institutions and corporates of all sizes. Here’s a comparison of the fees and charges for some of the top trading platforms in the UK. Gravestone Doji Pattern.

Commodity Trading

While there are risks associated with any investment, India’s growing economy and stable economic environment make it an attractive destination for investors looking to expand their portfolio. Find one in our advisor directory to help with your plan. Love reading their analysis on various stock. AMFI Registered Mutual Funds Distributor: ARN 188742. Please stay positive. Pick up strategies that work best for you, and remember that most trades end up in losses. Similarly, a cross of the 50 period EMA below the 100 period EMA signals that average prices start to drop and that a short term downtrend is about to form. Only advanced traders should trade on margin. Since the number of transactions per candlestick is constant, each volume bar reflects the average volume of all transactions of the corresponding candlestick. California: California Finance Lender loans arranged pursuant to Department of Financial Protection and Innovation Finance Lenders License 60DBO 74812. Position trading is a popular trading strategy where a trader holds a position for a long period of time, usually months or years, ignoring minor price fluctuations in favor of profiting from long term trends. You can even execute trades on the derivatives market, like an options trade, although this feature is restricted on some apps. Day trading requires constantly adapting to changing situations. Daily Options: While a similar strategy could be employed with other duration types, new zero day to expiration 0DTE options are same day contracts that expire within 24 hours of purchase. To minimize the impact of time decay, it is advisable to close the trade on the same day. A position is a quantity of an investment that a person or organization owns or is shorting. It is safe to assume that bulls were able to overcome sellers during that time. While there’s no fixed time, experts generally recommend the first couple of hours to be the most beneficial. In addition to a decade in banking and brokerage in Moscow, she has worked for Franklin Templeton Asset Management, The Bank of New York, JPMorgan Asset Management and Merrill Lynch Asset Management. Sometimes called IBKR for short, Interactive Brokers offers multiple types of accounts, including ones that work well for retail investors and professional and institutional investors. The trading rules can be used to create a trading algorithm or “trading system” using technical analysis or fundamental analysis to give buy and sell signals. Founded in 1790, The NASDAQ OMX PHLX, also known as the Philadelphia Stock Exchange is an options and futures exchange located in Philadelphia, Pennsylvania. ”The History of NYSE”. For example, AUD/JPY will experience a higher trading volume when both Sydney and Tokyo sessions are open. Both of these financial elements are necessary to calculate the gross profit. Those who access this site do so on their own initiative, and are therefore responsible for compliance with applicable local laws and regulations. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Use profiles to select personalised content. Rebecca Baldridge, CFA, is an investment professional and financial writer with over 20 years’ experience in the financial services industry.